Done-For-You

AI Agency

— Powered by EVA

Launch smarter. Sell easier. Automate everything.

Instantly offer AI services to your clients

Earn monthly commissions as a reseller

Use EVA to automate your own business

Reduce or eliminate your cost with simple referrals

How EVA Works (In 4 Simple Wins)

From zero tech to recurring income — all done for you.

Instant Setup — No Tech Required — CRM Included

EVA installs onto any website, connects with almost any CRM,

and every partner gets a free GoHighLevel CRM account included.

- LIVE DEMO -

See EVA Works in Real Time

Chat with EVA Right Now: This is the same AI assistant you’ll use or offer to clients — fully branded for them.

Talk to EVA

Instant demo • Always available

Tap to copy — or call instantly

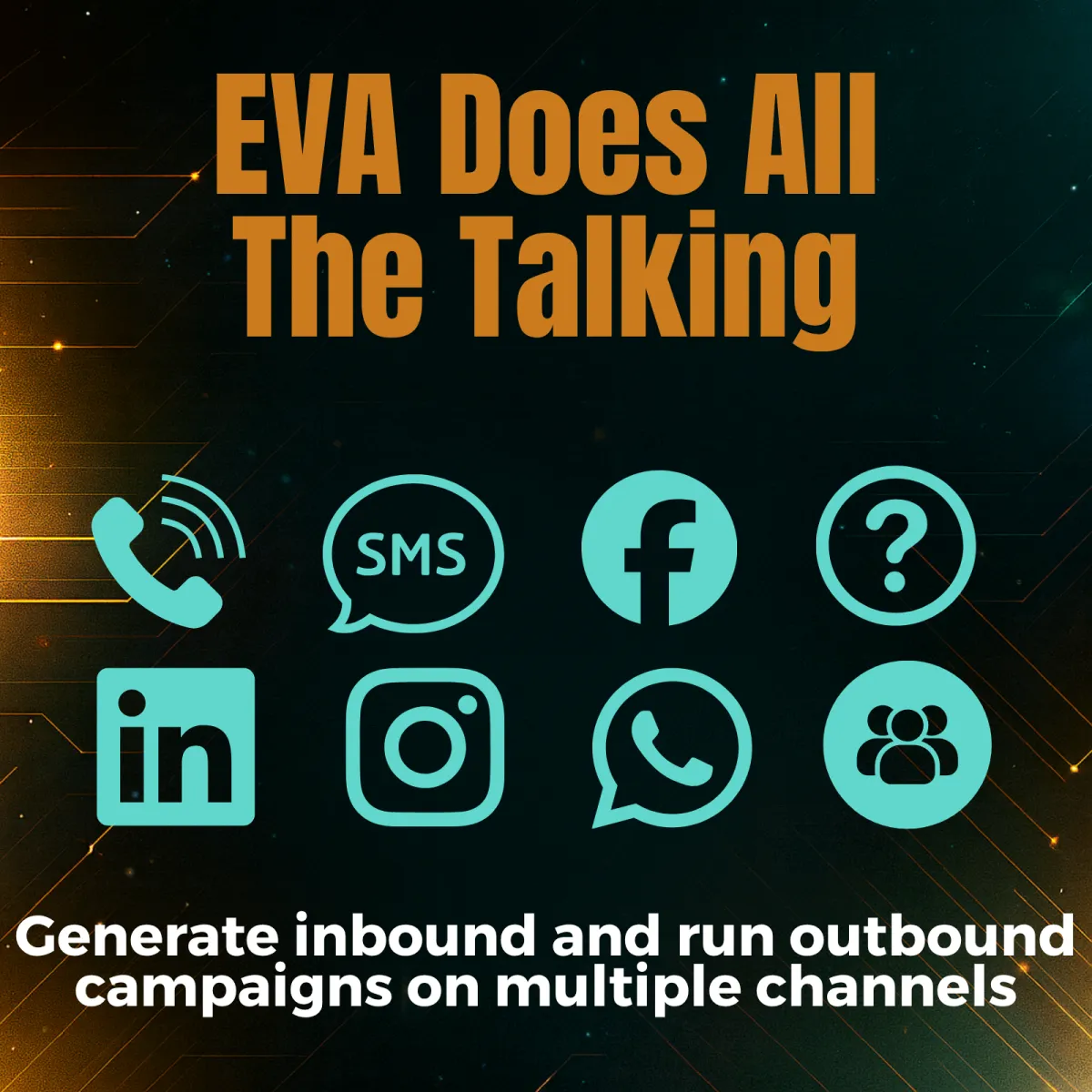

Call & Chat Widgets Available for your sites ⬆️➡️

See me handle chats and upsell 24/7 → WhatsApp me.

Want to hear me work the phones? Give me a call.

Test my instant follow-up via SMS → Text me now.

People Are Getting Results With EVA — Fast

EVA isn’t a chatbot. She books appointments, holds real conversations, remembers context, and adapts to each user.

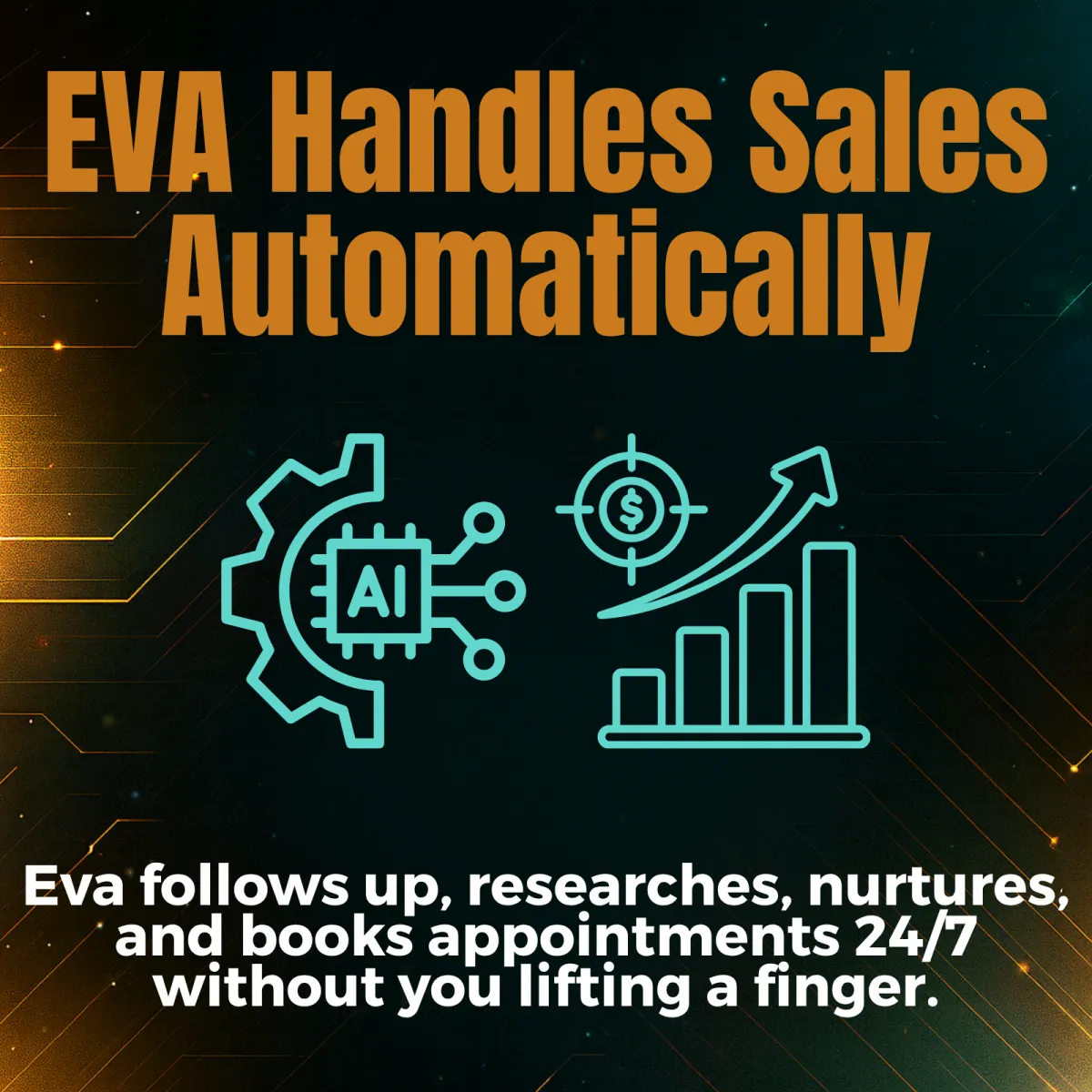

“I'm Booking Appointments Automatically!”

Real Calendar Results

EVA has already filled calendars with real appointments—completely hands-off.

Instant replies → persistent follow-up → booked meetings on autopilot.

“My Clients Want Their Own EVA Assistant!”

Clients Ask “Where Do I Get One?”

Every time someone tests EVA, they’re blown away. She feels human — remembers details, adapts, and keeps people engaged.

Most testers immediately ask how to get their own assistant.

“Eva is BY FAR - A Different Level of AI”

Not a Bot — A True AI Assistant

EVA handles full conversations, does live lookups, remembers context,

and never breaks character.

People instantly recognize she’s far beyond typical chatbots..

Whether you’re selling AI services or using EVA inside your own business — she’s built to scale your results.

Resellers, Agencies & Creator

Add EVA as a service you sell

Done-for-you delivery & support

Instant recurring revenue stream

Perfect for marketers, consultants, freelancers

Businesses That Needs More Sales

EVA handles follow-up & booking

Cuts no-shows and boosts conversions

Automates repetitive tasks

Works on all your channels 24/7

Black Friday Sale — 50% OFF Your EVA Setup for Life

(Coupon: 50PERCENTOFF)

Ready to Launch

Your AI Agency?

Start reselling EVA or use her inside your business

— setup is done-for-you.